Deemed as growth security, Tesla stock has received more attention from investing and trading communities in recent years. Today, not only do investors approach this financial product through formal exchanges, but they can engage in the over-the-counter market where they can trade Tesla shares on CFDs without buying and holding them over the long haul.

What is Tesla?

Tesla Inc., previously called Tesla Motors, is a Palo Alto-headquartered automobile and sustainable energy company. Tesla mainly works on the mission of accelerating the wide adoption of compelling electric vehicles among the mass. Moreover, the company designs and manufactures other clean energy products including solar roof tiles, solar panels, battery energy storage and so forth.

Despite such recent scandals as the cars’ cruise control activating automatically at times or Model 3 cars having trouble with brake calliper bolts, Tesla records the increasing demand for its vehicles in the second quarter of the fiscal year 2021. For this reason, the earnings per share (EPS) were 46% higher than estimates.

Tesla is a company working in the automobile industry. However, from the perspective of financial experts and investors, Tesla is more considered as a technology company. The main reason is the similarities between the growth rates of Tesla and tech giants (e.g. Apple Inc. or Alphabet Inc.). Tesla instils loyalty among customers through its products and changes business models by distributing cars to buyers instead of using franchise dealers; these traits are also commonly found in tech companies.

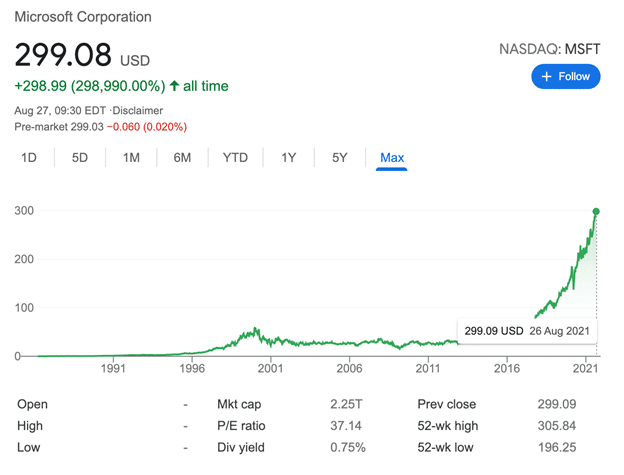

Tesla has witnessed the stock skyrocketing at a breakneck pace, especially since early 2020. By late August 2021, TSLA was trading at $701.16.

Tesla Trading Hours

Tesla shares are transacted on the Nasdaq exchange with the stock symbol, TSLA. The traditional trading session lasts from 9.30 AM to 4 PM EST (Eastern Time). What’s more, stockpickers can enter the stock market before and after regular hours:

- Pre-hour market: 4 AM to 9.30 AM EST

- After-hour market: 4 PM to 8 PM EST

When you plan to implement Tesla CFD transactions, the trading hours can be differently regulated by brokerages. For instance, at NSBroker, you are allowed to trade stocks 24/5.

How to Trade Tesla CFDs

Contracts For Difference, concisely known as CFDs, are financial agreements that give traders a differential between opening and closing prices. This difference can be positive or negative depending on whether your prediction of future market movements is correct. Commonly used for currency pairs in the secondary off-exchange market, CFDs have lately extended their scope to other financial products, including famous brand stocks.

Instead of buying and holding securities, CFD traders only need to speculate on short-lived price movements of instruments to make money. One downside is that CFDs do not require your physical holding of stocks, hence you receive no intrinsic benefits like representing part ownership of companies or obtaining periodic dividends. But in turn, you can achieve faster returns and start with modest initial capital.

To trade Tesla CFDs or any stock CFDs directly, you only need to follow the below steps:

- Open a trading account with an online broker: To sign up successfully, you have to send an online form with personal information to the brokerage.

- Verify your account: Many brokerages require some personal documents to prove the identity of the account’s owner.

- Make a deposit: If you decide to enter the real fray, you need to finance the account beforehand. The required minimum capital varies across brokers, for example, you only need $250 to trade Tesla CFDs with NSBroker.

- Install a trading platform: The platform is where you can deal in Tesla shares and other stocks.

Why Trade Tesla CFDs with NSBroker

Speculating on Tesla shares at NSBroker brings traders a wealth of perceived benefits as follows:

Regulated Broker

Trading CFD financial products on the secondary off-exchange market can expose you to financial crime if you carelessly choose scammers. Working with NSBroker is a decent option to keep your savings from unexpected attacks. This is because all operational activities of NSBroker are heavily regulated by the Malta Financial Services Authority (MFSA).

Beyond that, to obtain approval to work in the European Economic Area (EEA), NSBroker commits to the European Markets in Financial Instruments Directive (MiFID). Concurrently, the company is authorised by the following government bodies to provide their residents with investment benefits:

- Federal Financial Supervisory Authority (BaFin) in Germany – Registration No. 131055;

- French Prudential Supervisory Authority (ACP) in France – Registration No. 74397;

- National Securities Market Commission (CNMV) in Spain – Registration No. 3354;

- FINANSTILSYNET in Denmark – Registration No. 9221;

- Consob in Italy – Registration No. 3597.

Under the strict supervision of these regulators, NSBroker works toward transparent trading services, fair competition and a creative trading platform to bolster trading experience and the seamless execution of transactions.

Client Protection Scheme

To guarantee you can safely trade Tesla CFDs and trading services are transparent, NSBRoker launches a client protection scheme that specifies the following policies:

- Investor Compensation Policy: As NSBroker is under the MFSA’s legislation, particular groups of clients at the company will receive a reimbursement when NSBroker fails to fulfil its obligations or goes bankrupt.

- Negative Balance Protection: This policy protects your account balance from dropping below zero, hence helping you not fall into heavy debts. Particularly, NSBroker uses both the techniques and systems to automatically observe each of your transactions and risk management.

- When your savings reach the margin level of 50%, you will receive automated notifications from the broker. Accordingly, you may have enough time to either fund your trading account to meet the required margin amount or close all positions at the best available prices.

- Segregated Funds: Your funds will be completely separated from NSBroker’s bank account and thus saved into an independent bank balance for merely trading purposes. Furthermore, the company’s business functions are regularly reviewed by Price Waterhouse Coopers (PwC) to determine whether NSBroker meets industry standards about trading services.

Pure ECN

At NSBroker, only one type of account is offered: Electronic Communication Network (ECN) account. Serving as a pure intermediary, NSBroker connects clients outright with top-notch liquidity providers such as CitiGroup, Dukascopy Bank or Barclays. Those organisations will offer the best available prices for the traded instruments. Concurrently, ECN technology ensures exceptional trading conditions for your activities.

Besides, unlike full-service brokers or managed funds, NSBroker imposes cheaper services. Their main source of income comes from commissions which account for 0.05% of a transaction’s value.

Margin Trading

There is no need for megabucks to trade Tesla CFDs with NSBroker. To increase your buying power of Tesla stock, the company will permit your trading activities on margin accounts with the maximum leverage ratio of 1:5. This rate sounds inadequate for many traders, but proves suitable for beginners to avoid great exposure to risks.

MetaTrader 5

NSBroker provides clients with a chance to open Tesla CFD positions on MetaTrader 5 (MT5), the most cutting-edge trading platform in the world. The company develops a cross-platform and cross-device MT5. Accordingly, you can track the price movements of Tesla shares on a desktop screen or even on the go.

Compatible with varied asset classes, this accredited software facilitates your placing of orders and technical analysis based on pre-built indicators and charts. Other excellent features of MT5 include robot trading, which automatically executes trades based on pre-installed input metrics, and an economic calendar, which supports your observation of Tesla-related news.

Trading Education

Online brokerages are notorious for fewer interactions and support to clients. But this seems incorrect at NSBroker. As not all beginners are capable of trading Tesla CFDs, the company builds an academic library where rookie traders will be equipped with the fundamentals of CFDs. Moving forward, they can get free access to trading glossaries, video lessons and ebooks. Noticeably, account holders can participate in exclusive webinars and tutorials held by financial experts to develop a deep insight into CFDs trading and the stock market.

To support clients in technical analysis, NSBroker also develops the Analytics section where the company’s financial analysts evaluate past market data and propose their ideas of Tesla stock’s upcoming actions.