Most people know Microsoft Corporation through its Windows operating system, Office 365 and cloud services. However, from an angle of investors, is Microsoft stock high-value and worth buying this time whilst the tech industry is seeing more promising companies? According to economists and financial analysts, you should consider investing in this instrument with caution.

Microsoft: High-Profile Stock on the Market

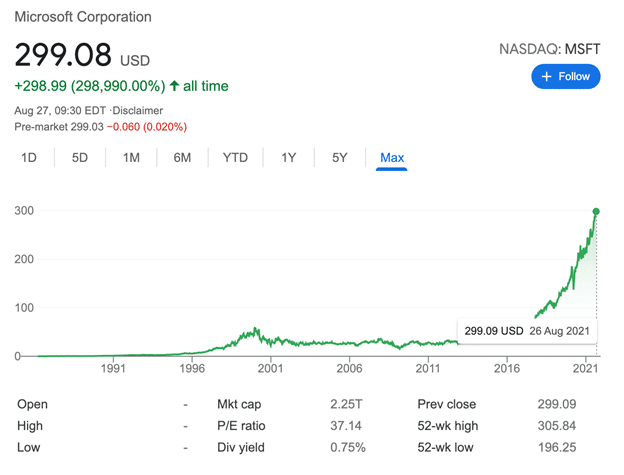

There is some argument about whether Microsoft is among the highest performing stocks in the world. From the stock investing point of view, Jim Cramer – CNBC’s “Mad Money” show host – excluded Microsoft (MSFT) from the FAANG stocks which represent five dominant companies in their respective fields: Facebook (FB), Apple Inc. (AAPL), Amazon (AMZN), Netflix (NFLC) and Google (GOOGL) (later known as Alphabet Inc.). Over a decade prior to 2013, the five mentioned companies witnessed threefold to tenfold growth in ROI for investors, whilst Microsoft lagged behind with a modest increase of no more than 1.5x.

However, the later stage experienced a gradual upturn of Microsoft stocks, in conjunction with consistent earnings. Therefore, a new acronym, FAAMG, was coined by Goldman Sachs to describe the best performing large-cap companies. According to the FY21 Q4 earnings release published on July 28, 2021, diluted earnings per share (EPS) and revenues exceed analyst forecasts, increasing 49% and 21% respectively.

Although MSFT’s value is rather low compared to the other five mentioned stocks, it is still one of the highest-profile securities in the market. After the company’s decision to increase Office 365 subscriptions for businesses, its stock spike was recorded afterwards. Besides, Microsoft is well-positioned to take advantage of cloud services which are projected to thrive constantly in the upcoming years. This cements the predictions of many investment gurus about MSFT’s bullish trajectory.

How to Buy Microsoft Stock

Microsoft stock is traded through the Nasdaq stock exchange with the ticker number, MSFT. Therefore, if you engage in the direct purchase program of Microsoft or make a purchase through brokerages, your transactions will be under tight regulations and hence backed up by the formal exchange and government bodies. However, the financial industry now also records a surge in stock CFDs traders.

Direct Purchase and Reinvestment Program

Like other US companies, Microsoft designs direct purchase and reinvestment programs which are authorised to the third-party administrator, ComputerShare. Moving forward, you can choose a one-time or recurring investment, whether buying Microsoft Corporation shares for the first time or registering for your existing holdings. These plans help you own Microsoft shares independently of brokerages, thus proving more cost-effective and convenient.

Investment Through Brokers

If you want your investment portfolio to be managed by a financial expert, you should invest your money in reputable brokers, financial services companies and even banks which provide investment services.

Normally, owning Microsoft shares through brokers will accompany higher charges for their services than direct purchases. Besides, the companies can offer a wide range of services to their clients. Full-service organisations and assorted funds can either make an investment decision on your behalf or enter the stock market under your instructions and manage your accounts. Accordingly, when working with an intermediary and wishing to own Microsoft stock, you should make that request to the account manager.

Stock CFD

CFD is an abbreviation of Contract For Difference. This financial contract stipulates that a buyer has to pay the differential between the opening and closing value of a traded instrument. Should the difference be negative, a purchaser will receive a profit back from a vendor. A CFD does not factor in the product’s underlying value, but rather enables retail traders to venture on the asset’s temporary price movements to make money.

In the off-exchange market, you can trade Microsoft CFD through discount online dealers with much cheaper services than conventional brokers. Concurrently, this type of trading also removes the process of receiving and holding Microsoft shares. If your estimates about MSFT’s future trends are correct, you will make faster and even greater returns on leveraged accounts. However, it can come with higher risks and thus worse failure. Not to mention that you will not benefit from Microsoft common stock’s intrinsic value such as periodic dividends or the partial ownership of the company.

Microsoft Stock and Your Portfolio

Although Microsoft stock appeals to many investors because of its perceived stability and potential growth, does it match your current budget and investment portfolio? There are many factors impacting your answer, mostly including:

Capital

Compared to other large-cap stocks, Microsoft stock may be lower. However, it reaches nearly $300 at the time of writing, which is seemingly considered rather high for retail investors. If you invest in MSFT directly through ComputerShare or any brokers, the question here is whether your budget allows you to make a huge investment in this security. Let alone whether you may receive capital gains from this deal. Even when you trade CFDs with a limited budget, picking up Microsoft stock is discouraged if its rivals’ shares bring more prospective benefits.

Risk Tolerance

Grabbing an individual stock is a speculative decision, whether you pursue buy-and-hold strategies or day trade Microsoft CFD. Assuming you realise MSFT accompanies more risks than other tech securities and stock benchmarks, but your portfolio hardly accommodates those stakes. So you had better look to index funds or other shares that fit your risk tolerance.

Tips on Investing with NSBroker

NSBroker is a Malta-based regulated broker which pledges to offer transparent trading services and a creative trading platform under the regulation of national and international authorities. To trade Microsoft CFD at NSBroker, you only need to register for an account, install the MetaTrader 5 platform and make a deposit. Besides, you should take the following key considerations to guarantee the seamless execution of trades and mitigate a losing rate.

Learn About CFD-Related Basics

Trading CFDs on margin accounts involves high risks and hence a greater possibility of failure. Therefore, beginners are highly advised to acquire a good knowledge of this financial contract. To facilitate your acquisition of CFD-associated fundamentals, the broker provides instructional materials in different forms (e.g. video lessons or ebooks). Noticeably, you can keep track of frequent webinars to listen to NSBroker’s financial analysts discuss specific topics related to CFDs and investment products. Grasping where your budget will be headed is one of the most important steps to trade NSBroker.

Use Risk Management Tools

Due to the mentioned stakes of trading Microsoft CFD, learning how to manage those monetary risks effectively should be among the top priorities. The common way to control incurred risks is using stop-loss and take-profit orders on the trading platform, whether you execute market or pending orders.

Stop-loss orders are exactly as they sound: they help you to avoid further losses by automatically closing your position at the pre-established stop level. Meanwhile, take-profit orders are helpful in locking acceptable profits. Where to put the stop-loss and take-profit levels depends much on your risk tolerance and risk-to-reward ratio.

Trade Microsoft CFD With Demo Accounts

Building a profitable trading plan is a must when you invest in Microsoft CFD at NSBroker. But to determine how effective the trading plan is, you should apply the plan in a simulation environment beforehand. Demo accounts will help you do so with virtual money and leverage ratios.

Improve Technical Analysis

For CFD traders, technical analysis is an essential skill. The trading platform contains a myriad of technical indicators and charts that prove helpful in evaluating the upcoming direction of MSFT’s movements. To support your technical assessment, NSBroker’s financial experts produce analytical articles that show their suggestions about how Microsoft stock will move in the following week.

Conclusion

Microsoft stock is a high-value blue chip that comes with stable growth and returns on investment in recent years. However, this does not mean the stock fits your portfolio. Whether holding the shares or just speculating on their movements, you should do a thorough analysis of Microsoft and its competitors to see which stocks deserve investment this time. Also, if you decide to include this equity in the investment basket, you ought to choose a suitable investment style to reach the best outcomes.