The stock price of Pfizer (NYSE: PFE) and BioNTech (NASDAQ: NBTX) climbed to their all-time highs of $52 and $463, respectively, this august. Their price was strongly supported by the US Food & Drug Administration (FDA) approval of the Pfizer-BioNTech COVID-19 Vaccine. However, both stocks soon lost ground after reaching important milestones. This raises the question of whether they and other stocks in the Biotechnology & Drugs sector can break out and move to new highs.

An Overview of Biotechnology & Drugs Sector

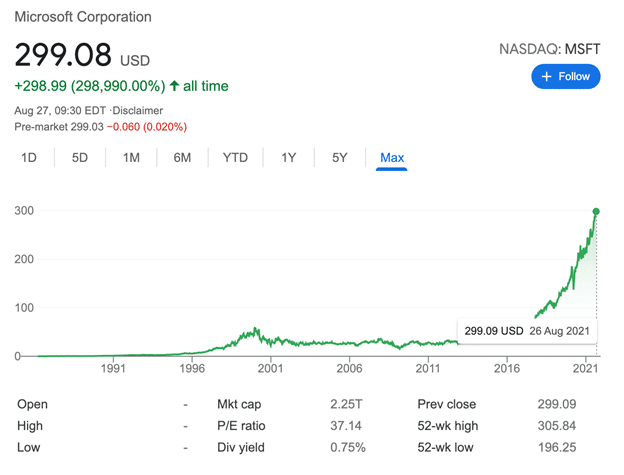

The stock market is among the most profitable investments during the two years of the COVID-19 pandemic. Social distancing induces most people to work from home, seek alternative incomes without having to go out and there is no better solution than online investing. However, in the stock market, especially in this period, certain industries outperform others as the money flows into sectors beneficial from social distancing such as Technology or ones helping repel the epidemic like Biotechnology & Drugs.

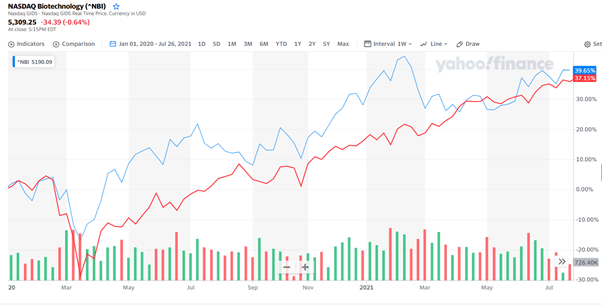

Looking at the Nasdaq Biotechnology Index (NBI) which represents Biotechnology and Pharmaceutical companies, we can see NBI – blue line – has prevailed over the S&P 500 – red line – most of the time since the start of the pandemic. In the same period, their price gains are 39.65% versus 37.15%, respectively. Battling against coronavirus is the number one target and this war still does not see its end, investing in the biotech & drug sector is no doubt a profitable decision.

The coronavirus pandemic may change investors’ views on this area. It was not until the pandemic that Biotechnology & Drugs truly gained a proper look at a hi-tech industry that can contribute significantly to the future of mankind while generating multi-billions of dollar profits simultaneously.

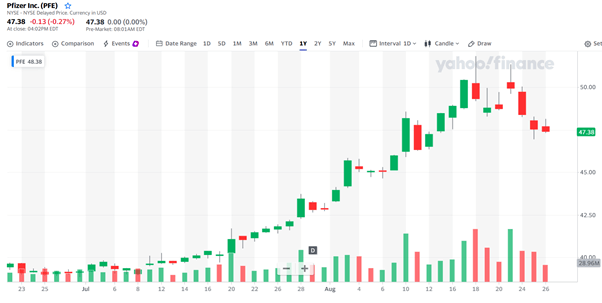

The Stock Price of Pfizer Hit Its All-Time High

Pfizer stock price heavily depends on the effectiveness of the Pfizer-BioNTech COVID-19 Vaccine against the coronavirus. As the virus variants keep evolving and spreading around continents, not only do governments but also investors eye on the vaccine protection capability.

And here comes the good news, the third shot of the vaccine is proved 86% effective, it also strongly boosts the protection against the Delta variant which has swept up many nations in recent months. The study of Pfizer mentioned that in comparison with the second shot, the third one helps raise the antibodies 5 times and 11 times for people in 18 to 55 and those in 65 to 85, respectively. The US CDC also recommended the third dose and as a result, PFE stock hit its all-time high of $52.

The stock price of PFE dropped soon after that but it immediately caught the second wind when FDA approved the Pfizer-BioNTech vaccine as the first COVID-19 vaccine. It was marketed under the name Comirnaty. On the stock market, PFE quickly surged with a gap but failed to break away. In the same period, BioNTech enjoyed similar energy as its BNTX peaked at $463 on August 10th before falling to around $350.

It is worth mentioning that Comirnaty as well as other vaccines like Moderna, J&J or AstraZeneca were only under emergency use authorization (EUA) before that. This is the main reason why many Americans refuse to get vaccinated while the vaccines have been introduced for months. Therefore, not just in developing countries but even in the home country of the vaccine, the vaccination rate is not a convincing number. On the approval of the Pfizer vaccine, the officials expect the fact that the vaccine satisfied the high standards for safety, effectiveness, and manufacturing quality required by FDA would make the public rest assured and get the shots eventually.

Additionally, the approval of the Pfizer vaccine paves a way for other pharmaceutical companies such as Moderna or J&J in getting the same license for their vaccines. In a broader view, this may create a positive effect on the biotech & drug sector and form a new age for those companies in terms of stock investing. As we all know, uniform development of an industry has a big impact and raises a strong trend lifting up all companies within.

What’s Next for Pfizer Stock?

That good news affects Pfizer in two ways. First, they lift the price instantly as we can see on the above PFE chart. Nonetheless, the effect seems to have a short duration since the price quickly falls off the peaks twice.

Second and more importantly, full approval and third dose mean Pfizer can continue to produce and sell a large number of vaccines and get tremendous revenue in return. Accompanying that, many developing countries are still facing a lack of vaccines as the majority of the population has not got 2 or even 1 shot yet. The demand is still there and it guarantees the increasing consumption of Pfizer vaccine in months ahead. In particular, Pfizer has recently forecasted its 2021 sales of $33.5 billion which increases by 29%. Therefore, investors owning PFE shares can expect positive business results from the company in the next year.

Now let’s take a look at specific figures, according to the report of the company, earning per share of PFE was $1.07 in the second quarter of 2021 which increased 73% compared to the same period of 2020. The reported revenue for Q2 was $19.0 billion. Both of the figures beat the consensus EPS and revenue of $0.96 and 18.5 billion in order. These impressive results are partially reflected by the growth of PFE stock price.

It also needs to be said that vaccines are normally not the biggest income source of a pharmaceutical company in comparison with drugs to deal with various diseases. Nonetheless, the global scale of coronavirus unwittingly boosted the sales of vaccines. Looking back to the time the vaccine was granted emergency use authorization in December 2020, the stock price of Pfizer has grown 20% since then while its partner – BioNTech has a much more impressive number of 260% in the same period. Both stocks are now in their peaks and are not on some level that attracts the majority. However, as the number indicates, we can see how high the impact the vaccine has on the stock price.

Final Thoughts

To conclude, we gather everything in a positive group and a negative group of factors. Starting with the positive one, biotechnology & drug companies are wise investments in the pandemic time as they play a key role in the war against coronavirus. In return, manufacturing and sales of products dealing with the virus bring tons of fortune to these big pharma. Since the start of the crisis in early 2020, NBI has outperformed the S & P 500 most of the time, indicating a big interest in this area and forming a clear uptrend.

The approval of the FDA on Pfizer-BioNTech vaccine as the first licensed COVID-19 vaccine along with the effectiveness of the booster shot ensure the demand of the vaccine and ultimately, the revenue of Pfizer in upcoming months. That demand comes from three sources which are:

- The developing countries which are in shortage of vaccines;

- People in developed countries once refuse to get vaccinated because of the worries about safety may change their minds and take the shot;

- The demand for the third dose which is six months away from the second dose.

As the virus keeps evolving every day, vaccines are still effective prevention before specialized medicines are mass-produced. They are the growing motivation for pharmaceutical companies.

On the other hand, both Pfizer and BioNTech stock prices are now on their top. In fact, they both decrease quickly after peaking. This means a part of investors are still doubting the prospect of these companies.